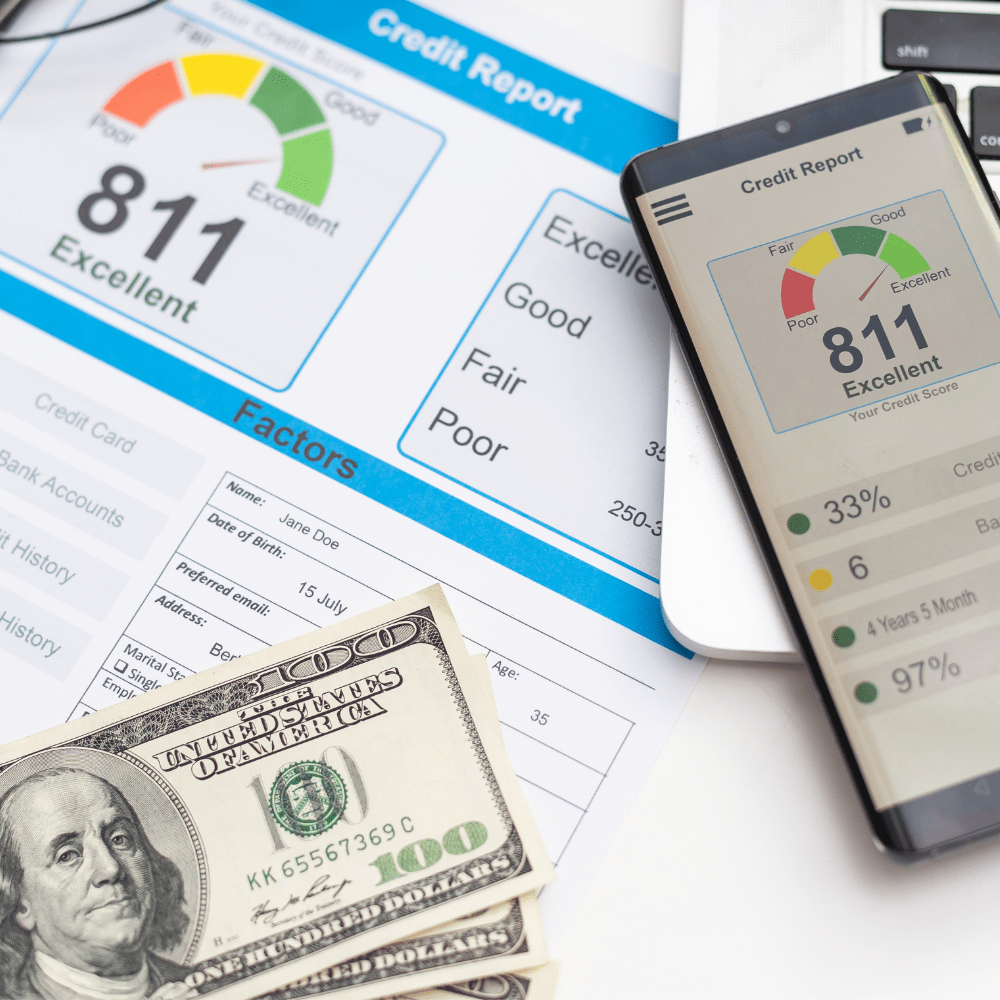

As a couple or single parent powerhouse, maintaining a strong credit score isn’t just important—it’s essential for your family’s financial well-being. A healthy credit score is your financial security system, and protecting your family as the provider responsible for all financial decisions.

Your credit score directly impacts:

⭐ Housing options and rental approvals

⭐ Interest rates on mortgages and auto loans

⭐ Insurance premium costs

⭐ Emergency funding accessibility

⭐ Employment opportunities in some industries

⭐ Utility deposit requirements

⭐ Qualifying phones to payment arrangements

When you’re raising children, your excellent credit score becomes the foundation that ensures financial stability, creates opportunities, and provides the safety net your family needs during unexpected challenges.

These 9 Proven Tips to Boost Your Credit Score Fast are for anyone looking to increase your credit score as quickly as possible. I can attest that everything listed here works. It is how I bought a house within 6 months of working on my credit with an increase of 100 points.

Most offices still rely on human communication from one office to another. For example, I had to call a couple of the debt collectors I had paid off to confirm they were relaying the “paid off” info to the credit bureaus. What I am getting at is “nothing” is perfect and there is some work to building your credit. Overall it’s pretty simple and straight forward, as long as you follow the steps you should see your credit score rise in a matter of 3 to 6 months.

If you are preparing to make a big purchase and need to boost credit fast, the best ways are below, but keep in mind it does take 3-6 months to really see progress on the history of your credit. Something I learned about credit and loans is that banks like to see “long” history so you can boost credit fast but a high credit score does not mean that you will qualify for all loans. It is important to research the type of loan you need and focus on building your credit score in weak areas.

The simple answer to boost credit fast is to manage your credit with financial responsibility.

*ੈ✩‧₊˚Boost Credit Fast in a Nut Shell *ੈ✩‧₊˚

Remove Collection Accounts (Gain 20-100+ Points)

Pay Off Credit Card Balances in Full (Gain 10-40 Points)

Lower Credit Utilization Below 30% (Gain 20-40 Points)

Remove Late Payments (Gain 20-60+ Points)

- Lower scores (below 600) may see a significant boost within 3-6 months.

- Higher scores (above 700) will see smaller but steady increases.

Pro Tip: While boosting your credit fast is possible, long-term credit health matters more. Banks prefer long credit histories, so focus on maintaining a strong credit profile rather than just chasing a number.

By implementing these proven credit-building strategies, you’ll be on your way to a stronger financial future—whether it’s for buying a home, securing a loan, or simply gaining financial freedom.

Remember that “fast” in credit improvement terms typically means 3-6 months rather than days or weeks. These strategies can help accelerate your progress, but consistent good habits over time are the true key to excellent credit.

9 Tips Proven to Boost Credit Fast

#1. Pay Bills on Time

As a busy mom who may or may not have adhd it is a must to set up automatic payments on all my accounts. Next step is keeping money in the checking at all times because half the time I don’t know what’s coming out. I set it up and forget it, just make sure money is in the account.

Paying bills on time has been the angst of my adult life. Being irresponsible with money has come full circle and blown up in my face. I learned over and over again and found out how much better I feel about myself when I keep the money in the bank instead of making dumb purchases. Now I have learned to budget out “spending money” so I don’t worry about bills being paid.

- Payment history makes up 35% of your credit score.

- Removing late payments: 20-60+ points

- Set up automatic payments or reminders to avoid late payments.

- Tip: don’t set up all payments on the same day!

#2. Check Credit Report

This was my first breakthrough in understanding why my credit score struggled. I discovered the strategic importance of prioritizing certain debts over others. Even more surprisingly, I uncovered several accounts that were fully paid off but never reported to the bureaus. After disputing these inaccuracies, my score jumped dramatically as these corrections were processed.

- Get your free credit report from AnnualCreditReport.com

- Dispute Errors

- Keep Track of Your Credit Score

#3. Pay Down Debt

This sounds redundant to paying bills on time, but this is where the real points start adding up. When you pay down debt and it is reported, you will see major positive changes to your credit report. It is important to analyze your debt. Pay of Debt collections first. Then pay down all other debt starting with the highest interest rate. It only makes sense to get rid of the highest interest debt first.

This all might seem very overwhelming, but it’s such an empowering venture that you will be so proud of yourself for doing.

Paying off debt is more simple then you might think.

- Removing collection accounts can increase your credit score 20 to 100+ points

- Pay Off Highest Interest Debt First

- Paying off credit card balances completely could add 10-40 points

- Stay in Contact with Debt Collector (make sure they report your “paid off” to the credit beurau”

- Take Screen shots of “Paid Off” or “Settled” accounts

#4. Use Credit Cards Strategically

What does it mean to strategically use credit cards? Well this has layers but lets start with the simple version. To be honest, I’m not a big credit card supporter. I think the interest rates on most of them should be illegal, however the point is to use a credit card safely and for the intent to build your credit score fast. If you are new to credit cards you don’t want more then 2 or 3 to manage and that is enough to really improve your credit dramatically. The goal here is to show you are responsible with making payments. So when a bank looks at your credit report they see a good long history of responsible use, which includes making payments on time and keeping utilization low.

I use my credit cards for specific things and auto pay them each month plus one more payment halfway before payment is due. This helps me because it keeps the balance low without having it become a large payment. Utilization plays a giant role in the size of your credit score.

Here is an example of how points can drop off your credit score when utilization increases:

Going from 10% to 30% utilization: 10-30 point dropGoing from 30% to 50% utilization: 20-50 point dropGoing from 50% to 70+% utilization: 30-80+ point drop

- Reducing credit card utilization from above 70% to below 30% can increase your credit score 20-40 points

- Keep credit card balances below 30% of your limit (ideally under 10%).

- Make more than one payment a month (I believe this had a positive impact on mine)

- Pay off high balances before the statement date to lower utilization.

- Increase Credit Limit (without increasing spending)

#5. Keep Old Accounts Open

Keeping old accounts open is a key to getting on the bank’s and lenders’ good side. They would like to see a long-term credit history. Even if it’s paid off, you don’t have to have it removed from your credit. Another thing is that you don’t want to open and close credit cards regularly, which causes an alert. It looks like bad management of credit use. If you must close a credit card due to the company changing their terms on you or not committing to their end of the bargain, then do it sooner than later, not right before you are applying for a loan.

Quick Answer. In general, keep unused credit cards open so you benefit from longer average credit history and lower credit utilization. -Experian

- Closing your oldest account can significantly shorten your credit history

- Generally, a 10-30 point drop is possible if it’s your oldest account

- The impact is greater if you have few accounts or a limited credit history

#6. Diversify Your Credit Mix

I’m not saying to load up on loans, all this means is to have a little mix so lenders can see you are responsible with different types of agreements without missing payments or maxing out accounts. However, it is not a good idea to open new loans or credit cards just for the sake of variety or right before a loan assessment (believe me). You don’t want to overload yourself with debt, it’s all about managing it responsibly. No one wants to work just to pay off debt.

Investopedia says: “Diversification thus aims to include assets that are not highly correlated with one another. Most investment professionals agree that, although it does not guarantee against loss, diversification is the most important component of reaching long-range financial goals while minimizing risk”

- Having a mix of credit cards, loans, and other accounts improves your score.

- Don’t open accounts unnecessarily, but a secured credit card or small loan can help.

8. Become an Authorized User

This is not my favorite way and I have never done this because I feel awkward about it but it is an option and maybe for some it really makes sense. I will do this with my kids when they are over 18 if they are open to it, just to give them a jump start on their credit score.

- Ask a family member with a good credit history to add you to their credit card.

- Their positive payment history boosts your score without requiring a new account.

9. Limit Hard Inquiries

You know when I said you don’t want to open new accounts right before you are being assessed for an important loan like a vehicle loan or a mortgage. Hard inquiries are an ugly look to lenders. For one thing if these hard inquiries are rejections this is a big red flag to the important lender you are applying with. It also looks irresponsible, all negatives. Hard inquiries also drop your credit score by up to a

- Every new credit application results in a hard inquiry, which can temporarily drop your score.

- Only apply for new credit when necessary.

- Banks and other lenders do not like seeing several rejected hard inquiries, which raises a red flag

10. Use a Credit-Boosting Tool

I depend on credit tools to keep me on track. I check in on them frequently to make sure nothing new happened that I am unaware of. There are lots of great tools now that can add things like your utilities and rent to your good payment history. You wouldn’t believe how much this helps.

- Services like Experian Boost can add utility and phone bill payments to your credit report.

- Credit Karma helps keep track of your credit history

- Rent Reporter can help if you want your rent payments to help build your credit score. It also allows you to add your utility bills.

Thankyou for visiting, if you have any ideas or tips that help to boost your credit fast please comment below!